Haseung Jun

J

Jeanne Stansak

Haseung Jun

J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

The financial sector is the part of the economy made up of institutions that bring together lenders and borrowers. This includes institutions like banks. Financial assets are basically things that hold value. As you might guess, a key example is cash.

Key Vocabulary

- Liquidity💧 —The ease with which a financial asset can be accessed and converted into cash. Cash is the most liquid asset. It can most quickly and easily be converted into other assets. Other assets are not as liquid as cash. For example, if you have invested money into a certificate of deposit (CD), in order to maintain a higher interest rate, you have to keep your money in there for six (6) months. This causes a decrease in access to this money should you need it. Items like real estate, fine art, and other collectible have low liquidity because it takes a while to get your investment out of them.

- Rate of Return—Net gain or loss of an investment over a specified time period. People prefer investments that have a higher rate of return. Many times, this involves looking at the various interest rates on various investments.

- Risk—Chance that an outcome or an investment's actual gains differ from the expected outcome. Different people have different levels of risk they are willing to take on when it comes to investments. Typically, someone closer to retirement would not be as willing to enter into a higher risk investment than a person that is 15 years away from retirement.

- Bond—An interest-bearing asset often issued by businesses or the government. Sometimes they are referred to as securities.

- Stock—A security that gives you ownership in a company.

Stocks

Stocks are a security that gives you ownership in a company. But what does that exactly mean? Well, it represents your claim of ownership of the firm that you paid for. Firms raise money with capital investment by selling stocks for partial ownership. This is called equity financing. It's done in order to avoid debt, but it also gives way to external control over management and profits of the firm, since stocks are bought for ownership.

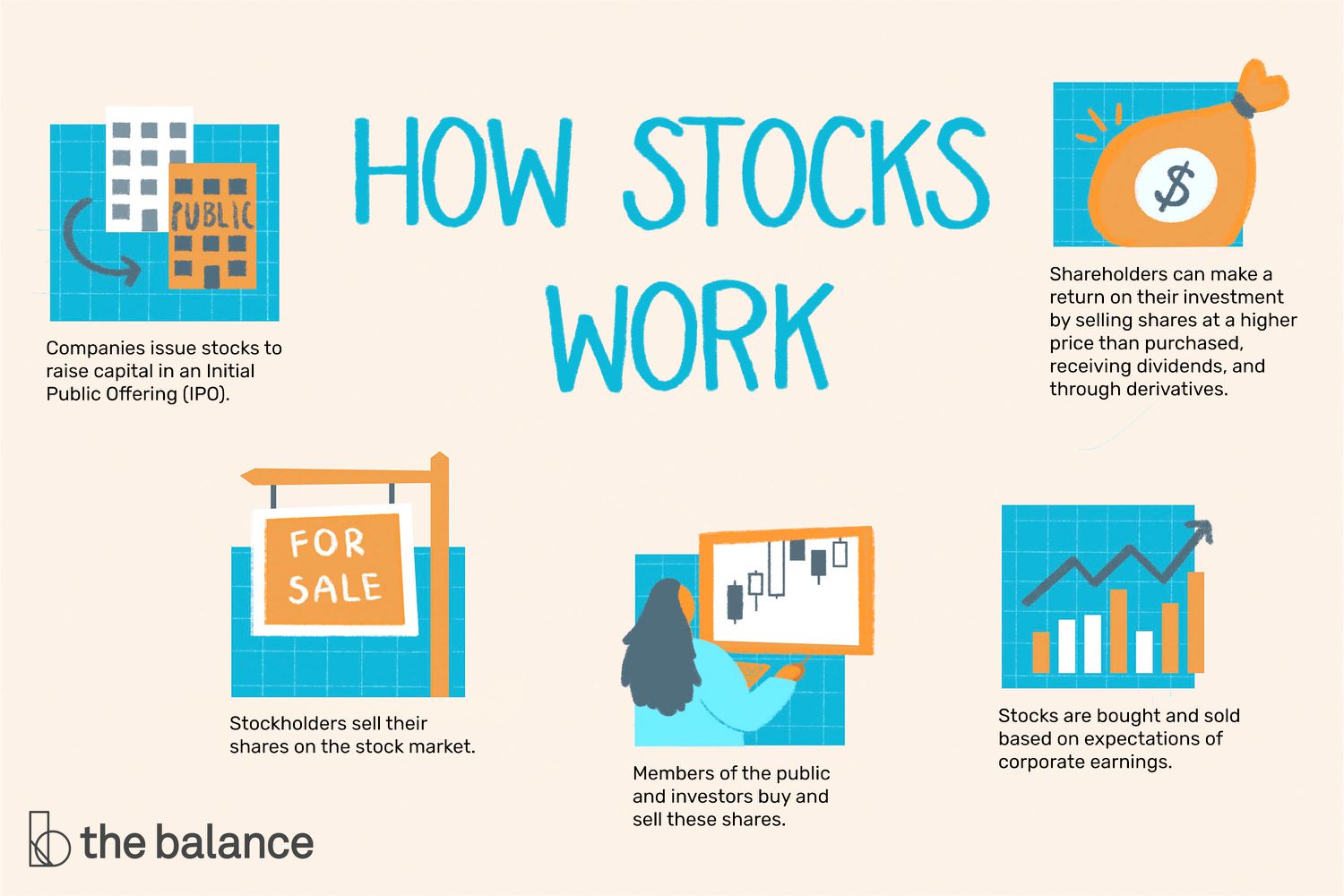

Image Courtesy of The Balance

Stocks, as shown in the image above, follows a process of being sold on the stock market. The public then sells or buys shares, with prices that are determined by company growth expectations. These shareholders can make a profit by reselling stocks at a higher price.

Bonds

A bond, on the other hand, is an interest-bearing asset issued by a business or government. When a firm wants to raise money, it'll issue a bond that promises the holder it'll give back the same amount plus interest. So then you'll basically "fund" this firm with a bit of money hoping to get more as time goes on. Basically, you're weighing the opportunity cost of holding onto the money or buying financial assets like bonds. In this case, the opportunity cost of holding the money with you is the interest that you could have earned if you would have bought the bonds. This is sometimes also called debt financing, but unlike stocks, it's not really getting ownership of the firm.

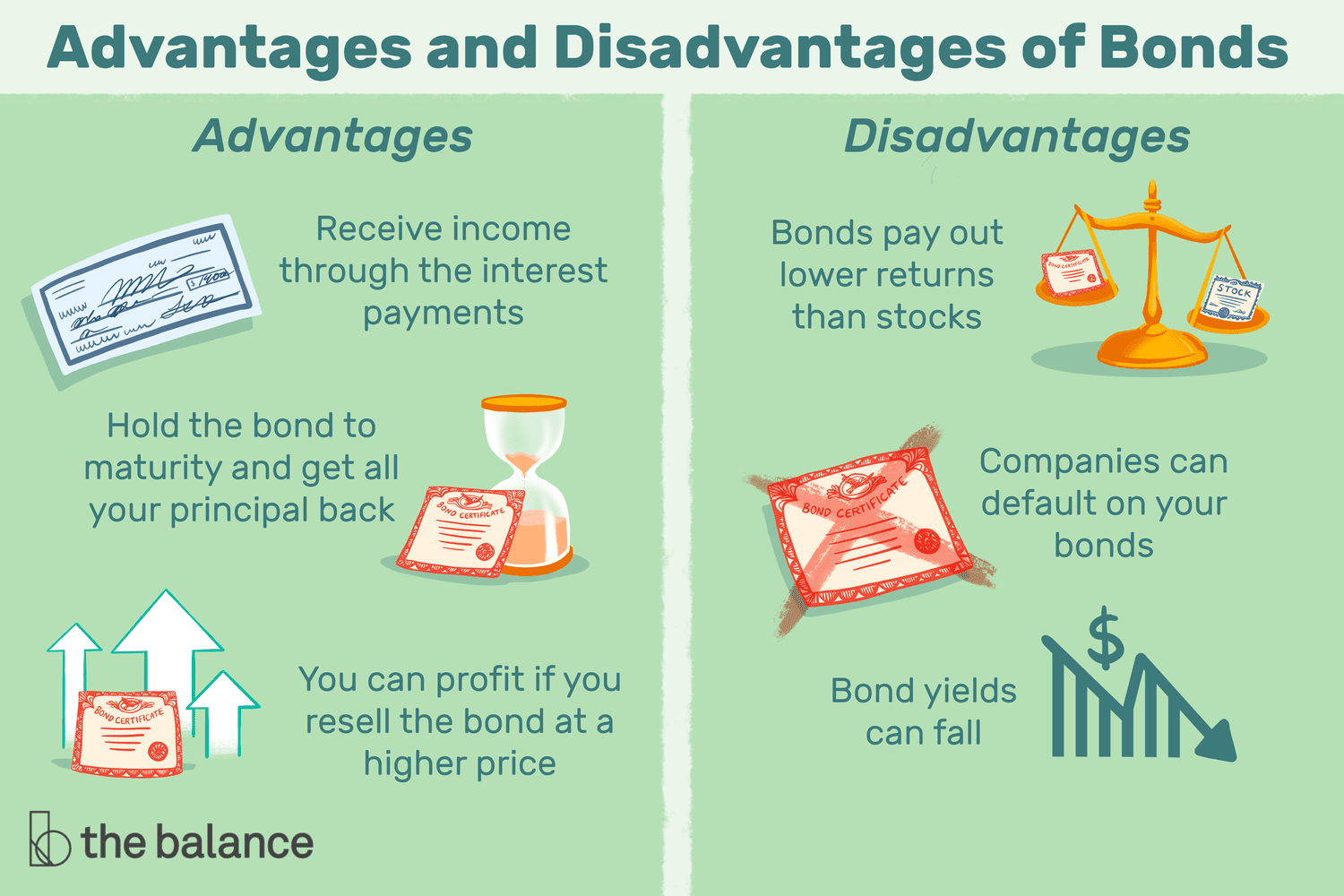

Image Courtesy of The Balance

Advantages include receiving income through interest payments, being able to get all your money back, and being able to sell it at higher prices for profit. It's a convenient way to both make money or store money until later use. However, it also has its downsides. Bonds don't pay much as stocks, companies can default, or cancel, your bond. In addition, bonds can fall in value, so it's always good to think ahead before buying financial assets.

Loans

As you know it. Basically the process of borrowing money and repaying it back with interest. Credit cards are a type of loan. We like to think of credit cards as part of the money supply, but in reality, it's actually just taking out loans from the bank. You pay something with your credit card, but it's actually the bank paying for you. Then, after a certain period of time, you repay the money with a bit of interest.

Bank Deposits

Bank deposits refer to the money in your bank account. It's basically your checking account, or demand deposits. You can use your money whenever you please, and there isn't any interest tacked on your spending. Think debit card.

Both bonds and stocks can be sold in the secondary market

Bonds and Interest Rates

Bond prices and interest rates have an inverse relationship. People prefer higher interest rates because they are given a greater rate of return. Most bonds pay a fixed rate of interest so as interest rates fall, they become more desirable which will push their price up. The opposite is true if interest rates are on a rise. Consumers are less interested in the fixed-rate interest rates that come with a bond, so they demand less of them, decreasing the price of the bonds.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

© 2024 Fiveable Inc. All rights reserved.