4.3 Definition, Measurement, and Functions of Money

4 min read•june 18, 2024

Haseung Jun

J

Jeanne Stansak

Haseung Jun

J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

Money can take several forms. One form is what we call fiat money. Fiat money is something that serves as money or currency and has no other important uses. Examples of fiat money include our paper money and coins. Another form of money is called commodity money. Commodity money is something that performs the function of money and has an alternative, non-monetary use. Some examples are gold, silver, oil, precious metals, and tobacco.

Functions of Money

There are three functions of money: medium of exchange, unit of account, and store of value.

In order for something to be considered money, it has to satisfy these three functions. There are various examples of each of the functions.

Medium of Exchange

Money must always be able to be easily transacted. If you want to buy apples, you should be able to at the local grocery store without much problem. In a sense, it's a convenient way to exchange what you have for what the grocery store has. Think of getting paid. It's also an efficient way to get rewarded for your work without creating a hassle about what you should get.

Look at the image below. How do you know if your goat is worth the same as a lamb? Should you get a lamb in return for your goat? Is it a fair trade? What if goats are more valuable? How do you know what to add to the trade in order to make it a fair one? With money, everything's laid out, no problems in buying or selling, whether it's a good or labor.

Image Courtesy of Study.com

Unit of Account

It also has to be able to show value. How do you know if cheese is more valuable than eggs? How do you know if diamonds are more valuable than a pencil? Usually, we look at the price. If the price of a diamond is higher than a pencil, you know it's more valuable.

Or think about a house? How do you know if your house is more valuable than the house across the street? Money (or price) sets a value that everyone can understand. It's almost a universal measurement system of value.

Image Courtesy of Golden

Store of Value

Lastly, we have a store of value. This means you can store its value without losing it (this of course, only stands true if prices are not increasing too rapidly). If you hide your $20 allowance under your bed, chances are, it'll still hold its value the next week or even the next year. If you hide your favorite Oreos under your bed, after a month, it won't hold its original value of being an awesome delicious cookie. Instead, it'll just be a piece of baked flour with moldy cream in between.

Image Courtesy of Techonomy

- A high school senior depositing his part-time salary into a savings account is an example of the function store of value. Another example of store of value is a bank investing $10 million into a portfolio of stocks and bonds.

- An example of the unit of account function is when a name-brand good is twice as expensive as a similar, generic good.

- A retired couple spending $9000 on a month-long European vacation is an example of the function: medium of exchange.

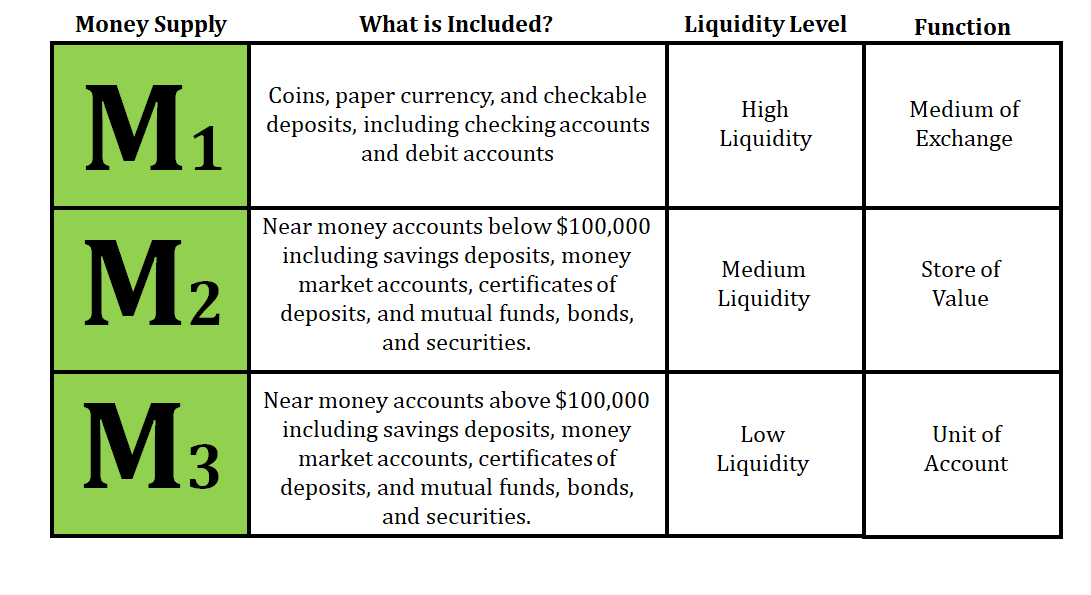

Measurements of the Money Supply

Different types of money are placed into categories based on what they include, their liquidity, and what function they typically perform. Liquidity refers to how easily something can be converted to cash. Surprisingly, one thing that is not considered money is a credit card. A credit card is actually a short-term loan with excessive interest rates. The money supply is measured by adding M1 and M2. These are two categories of money that matter for the AP exam, although a new category of M3 has been recently emerging.

- M1 = cash + coins + checking deposits + traveler's checks

- M2 = M1 + savings deposits + small time deposits + money market deposits + money market mutual funds

M1 and M2 together refer to the money supply. Because even money has its own market, we keep track of the supply of money. In this case, the supply of money is constant (think about it!) so we have a vertical supply curve.

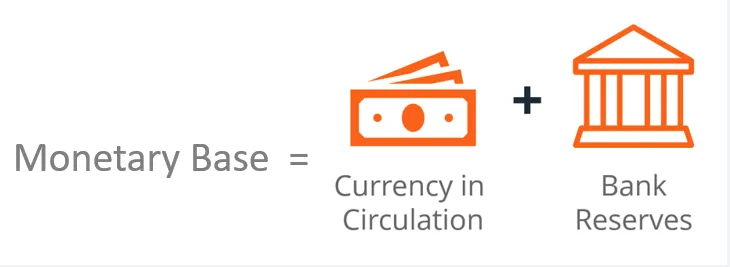

Monetary Base

The monetary base (M0 or MB) refers to the money in circulation or in the bank reserves. It's basically the physical paper and coin currency that is being used by the economy and bank deposits. This is NOT included in the money supply. Instead, it details the final settlement of transaction. If you use cash to pay off debt, that's monetary base. But if you use a credit card to do so, it's not because credit cards are not the final step of the transaction.

Image Courtesy of CFI

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

© 2024 Fiveable Inc. All rights reserved.