Haseung Jun

J

Jeanne Stansak

Haseung Jun

J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

Balance of Payments Accounts

Balance of Payments accounts measure all international transactions in a year. This includes the sale and purchase of goods/services and assets. There are two accounts within the balance of payments: (1) the current account, and (2) the capital account. Keep in mind, adding the current account balance and capital account balance should always equal to zero.

Current Account

The current account includes the following components:

- Net exports—The difference in the value of all exported goods and services sold and all imported goods and services purchased, including labor. Exports count as a positive asset and imports count as a negative asset. If a country has more exports than imports, it has a trade surplus. If a country has more imports than exports, it has a trade deficit.

- Net investments—Any interest or dividend paid to or from domestic investors.

- Net transfers—Any aid or grants paid to and from the domestic economy. This includes international aid or the transfer of income. Paid to the domestic economy is positive, from is negative.

The current account as previously iterated shows the imports and exports (and their payments) of goods and services. It also shows investments made by foreigners and by Americans on American assets and foreign assets, respectively. If the US sent more USD abroad then receiving foreign currency, the balance of the current account would be negative. On the contrary, if we received more foreign currency, the current account would be positive.

Capital Account

The capital account includes the following components:

- Financial Investments—The purchase of foreign and domestic financial assets. Foreign purchase of domestic assets is positive, and domestic purchase of foreign assets is negative.

- Real Investments—The purchase of foreign and domestic land and businesses, including plant capacities and factories. Foreign purchase of domestic assets is positive, domestic purchase of foreign assets is negative.

The capital account, looks at real estate or financial assets of another nation. For example, if a Swedish firm buys a manufacturing facility in Idaho, this is considered in the capital account. If an American firm buys a shipbuilding firm in Sweden, it would be an outflow of American assets and investments to foreign nations. If there was more capital investment within the US than American investments abroad, that's a surplus balance, making the capital account positive.

Official Reserves Account

This is some Fed stuff. They hold some foreign currency which is called the official reserve. If there's a balance of payments deficit when adding current and capital accounts because the US sent more dollars out than receiving foreign currency, the Fed comes in and pays with their official reserve foreign currency to make the deficit disappear and make it 0.

It's kinda like the concept of using money from your savings account to save your negative checkings account. If we have a balance of payments surplus, in which we have more dollars going abroad than foreign currency coming in, the Fed will take the surplus currency and save it as official reserves until we need it.

Circular Flow of Dollars

With a few exceptions, the US dollars sent to foreigners should be equal to the US dollars that foreigners send to Americans. This is explained though the circular flow model. It's another example of it!

Think about it. First, let's say Americans import jackets from France. This would result in dollars leaving the country, with the US current account as a negative entry. Now people in France have dollars. But what are they going to do with dollars? They wouldn't be able to use dollars other than using it to buy American products. Maybe a Ford car. This would lead to the purchase of American goods or American assets (like stocks). Then these dollars would return as a positive entry in either the current or capital account. Then the Fed would come in and do something with official reserves to make it equal to zero.

This means dollars leaving the US would end up coming back to the US. Basically, everything would come back.

Hypothetical US Balance of Payments

| Current Account | Notes: | ||

| Goods Exports | $30 | ||

| Goods Imports | -$50 | ||

| Balance on goods | -$20 | ||

| Service Exports | $18 | ||

| Service Imports | -$12 | ||

| Balance on services | $6 | ||

| Balance on goods and services | -$14 | trade deficit | |

| Net Investment Income | -$5 | ||

| Net Transfers | -$7 | ||

| Balance on current account | -$26 | US sent more USD abroad then receiving foreign currency | |

| Capital Account | |||

| Inflow of Foreign Assets to US | $35 | ||

| Outflow of US Assets Abroad | -$20 | ||

| Balance on capital account | $15 | more foreign capital investment within the US than American investments abroad | |

| Official Reserves Account | |||

| Official Reserves | $11 | ||

| $0 |

Table from Five Steps to a Five Macroeconomics

Examples

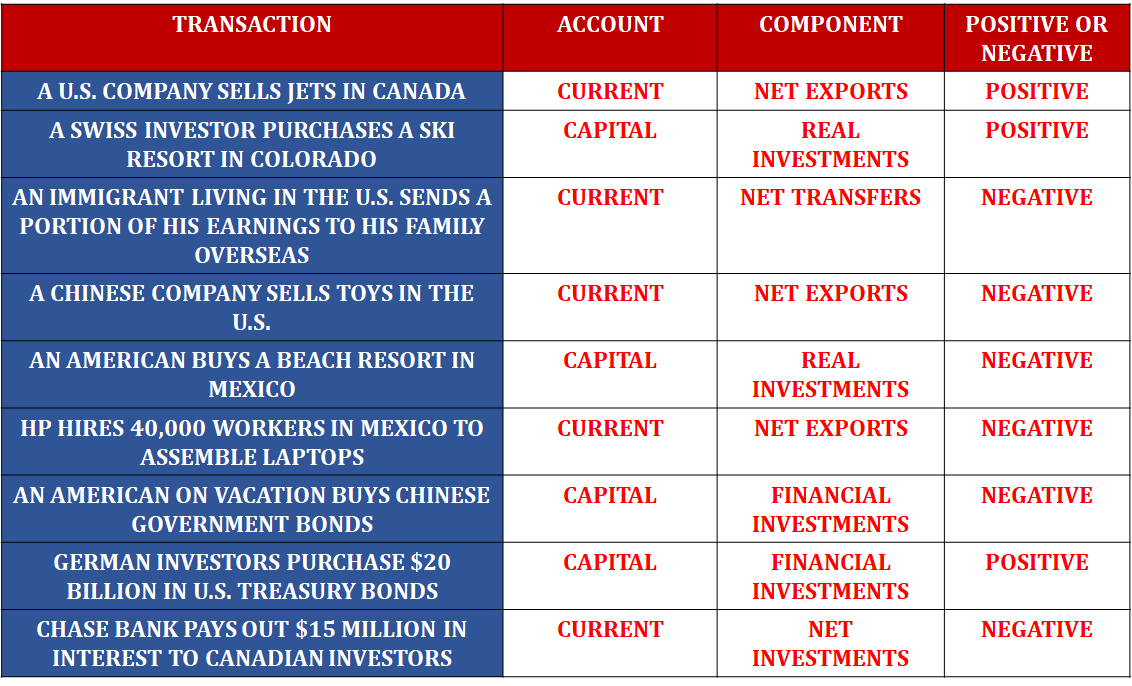

Let's look at some different examples from the current and capital account:

💡 A quick way to determine if an asset is positive or negative is:

- If the money for the transaction is flowing out of the country it is negative

- If the money for the transaction is flowing into the country it is positive.

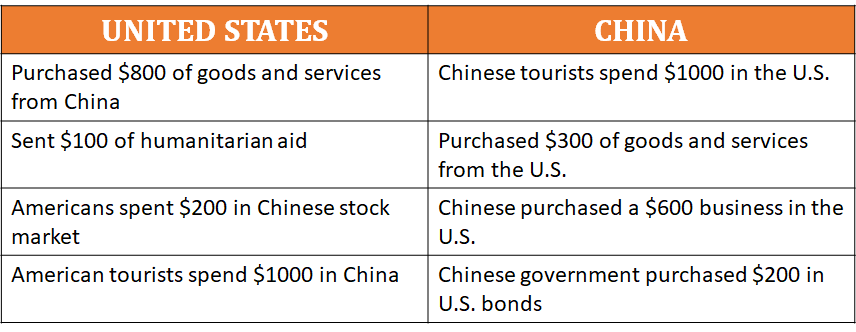

Sample Balance of Payments Between Two Countries

Looking at the example above, the United States has a trade deficit of $500 ($300 Exports - $800 Imports) and China has a trade surplus of $500 ($800 Exports - $300 Imports).

The value of the current account for the United States is a deficit of $600. This is calculated by adding the trade deficit of $500 to the $100 in humanitarian aid that is leaving the country, so it is negative. You would also include the purchases made by Chinese tourists and money spent by American tourists but since those amounts are both $1000 they cancel each other out.

The value of the current account for China is a surplus of $600. This is calculated by adding the trade surplus of $500 to the $100 in humanitarian aid that they are receiving from the United States which is positive. You would also include the purchases made by Chinese tourists and money spent by American tourists but since those amounts are both $1000 they cancel each other out.

The value of the financial account for the United States is a surplus of $600. This is calculated by adding the +$600 they receive for the purchase of a U.S. business by the Chinese, the +$200 they received from the Chinese government purchase of U.S. bonds, and the -$200 spent on the American investment in the Chinese stock market ($600+$200-$200).

The value of the financial account for China is a deficit of $600. This is calculated by adding the -$600 spent on the U.S. business, -$200 spent on the purchase of U.S. bonds, and the $200 they received from the investment by the U.S. in the Chinese stock market. (-$600-$200+$200).

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

© 2024 Fiveable Inc. All rights reserved.