Haseung Jun

J

Jeanne Stansak

Haseung Jun

J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

Multipliers

Basic Vocabulary

- Multiplier effect—The idea that an initial change in spending will set off a spending chain that is magnified in the economy.

- Marginal propensity to consume (MPC)—How much people consume rather than save when there is a change in income. This can also be explained as the portion of each new dollar of disposable income that consumers will spend rather than save.

- Marginal propensity to save (MPS)—How much people save rather than consume when there is a change in income. This can also be explained as the portion of each new dollar of disposable income that consumers will save rather than spend.

MPC and MPS

Marginal Propensity to Consume (MPC) is calculated by dividing the change in consumption by dividing the change in disposable income. It's referring to how much more you are willing to spend if you have an increase in income. For example, if your income increases from $50,000 to $60,000 (a change income of $10,000) and your consumption changes from $45,000 to $54,000 (a change in consumption of $9,000) then your MPC is 0.9 ($9,000/$10,000).

Image Courtesy of Wall Street Mojo

Marginal Propensity to Save (MPS) is calculated by dividing the change in savings by dividing the change in disposable income. It's how much more you are willing to save if you have an increase in income in a certain amount. Taking the same change in income as above, an increase from $50,000 to $60,000 (a change income of $10,000) and your savings changes from $5,000 to $6,000 (a change in saving of $1,000) then your MPS is 0.1 ($1,000/$10,000).

When we add MPC and MPS together, it always equals one because, for every new dollar you receive, you have the option to either save it or consume it.

Spending Multiplier💰

We know that when there is an initial change in spending, it will set off a spending chain that is magnified in the economy. The spending multiplier is the number we use to identify the total change in spending we will see after the initial spending.

Let's look at an example:

- Businesses start investing more by $10 so more money is added into the economy 🤑

- $10 now becomes income for some people with MPC of 0.8, so households spend $8 and save $2

- $8 becomes income for other people again and they spend $6.40 and save $1.60

- The $6.40 becomes income for other people yet again, so they spend $5.12 and save $1.28

This process continues to repeat until there's no more to save (the amount becomes too small). Right now, after 4 rounds, we have $10 + $8 + $6.40 + $5.12 = $29.52, which is an increase in GDP. If you add this up an infinitely many times, you'll be doing some extensive calculus. But instead for us non-calculus people, we have something called multipliers, which does the add-infinitely-many-times-thing for us.

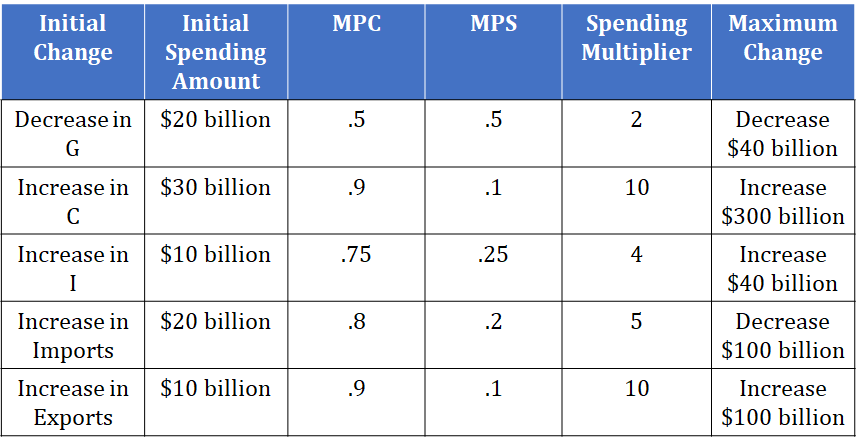

The formula for the spending multiplier is 1/MPS. There are times when you will be given MPC and you have to calculate MPS first before you can calculate the spending multiplier. Remember that 1 -MPC = MPS. These changes in spending can be an increase in spending or a decrease in spending. Let's look at some examples:

Just a reminder that when we increase imports, it actually decreases overall real GDP. In this table, when there is an increase in imports, there is a decrease in the maximum amount of spending. Also, when we increase exports, we increase the overall real GDP. In this table, when there is an increase in exports, we see an increase in the maximum change in spending.

Tax Multiplier

The tax multiplier is used to determine the maximum change in spending when the government either increases or decreases taxes. The tax multiplier is basically the opposite of spending multipliers. It talks about how much people will not spend if taxes increase. If our net worth decreases because of taxes, it's natural for people to cut back on spending right?

The formula for this multiplier is -MPC/MPS. The tax multiplier will always be less than the spending multiplier. When spending occurs, we know that all of this money will be multiplied in the economy. But, when taxes are increased or decreased, not all the money received goes back into the economy. For example, if the government decreases taxes which gives individuals more disposable income, there is no guarantee they are going to spend all of the additional income.

Let's look at how we calculate this.

If the MPC is 0.8 and the government imposes a $50 increase in taxes, what is the tax multiplier and what happened to the GDP?

tax multiplier = -MPC/MPS

tax multiplier = -0.8/0.2

tax multiplier = -4

GDP change: -4 * $50 = -$200

One fun thing about tax multipliers is the fact that tax multipliers are smaller than spending multipliers. This is because spending multipliers have an immediate impact on the economy, but tax multipliers first have to go through someone's income before having an impact on the economy.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

© 2024 Fiveable Inc. All rights reserved.